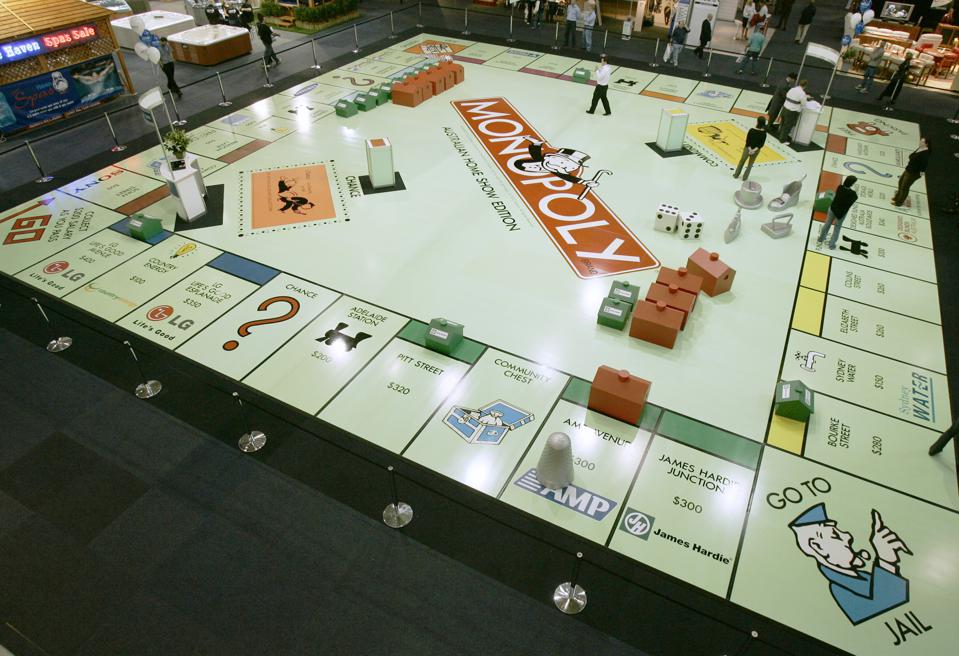

Think back to the last time you played Monopoly; what is the one thing the winner has? The most assets. They have a lot of the assets on the board from real estate with homes and hotels built on them to railroads and utility companies. To win at the game of Monopoly, assets are the key. It’s no different in life.

When you first start playing, what do you do every time you land on a square that somebody hasn’t already bought something on? You buy whatever they’re selling. You’re accumulating assets. What if you just sold it the next round to another player for cash? You would lose. You win by not selling for cash. You win by continuing to grow your asset base. You may sell something strategically to invest in something else so you can expand and make another property even better, like building a hotel.

That is what wealthy individuals are doing – they are accumulating assets that yield passive income down the road. They aren’t selling them for cash, as cash is not an asset unless it is earning a return, which it might not be doing if it is sitting in your checking account. As soon as you sell the asset for cash, you no longer own that asset or its cash flow.

The game of Monopoly is won by the accumulation of property that generates ongoing income. In the real world, real estate is indeed the best asset and source of income. Why? You may never pay tax on real estate, and neither will your family. I could own real estate and it could grow from a dollar to $10 million, and I will have paid nothing in tax. Zero. Meanwhile, the guy at McDonald’s made $400 and paid more in taxes than I did, and I made 10 million bucks. That’s real estate.

What are the rich not doing? Selling income-generating assets. That’s a minority of their income. Where do they make most of their money? Right there in that asset category. Just over a third is coming from work. They still do it, but that’s not where they’re making most of their money. They’re making most of their money from what I call your “Infinity Bucket” – incomes that are derived from real estate and dividends. They may still earn wages, but there is often a specific reason for it. They want to qualify for certain lending, or maybe they’re putting it into a tax deferred plan. The IRS publishes data every year in something called the IRS Data Book. It tells us that for people who make over a million dollars a year, 36 percent of their income comes from the Infinity Bucket—17 percent from capital gain and 47 percent from rents, royalties, dividends, and interest. These are the profits that come from passive investments.

Consider these additional statistics regarding individuals with an income exceeding $1 million:

- 65 percent of them have at least three sources of income

- 45 percent have income from four sources

- 29 percent have income from more than five

Think about this: two-thirds of rich people have at least three of these income sources. Do you want to be rich? I suggest you need to have at least three sources of income. Start building those up. Rents, royalties, dividends, interest, capital gains, both short term and long term, all come from assets, not from you working. In other words, you’re not trading your hours for money. The asset makes the money. Those types of income sources don’t require you. That’s what the wealthy do.

If you are ready to get ahead and win at the real-world game of Monopoly, it’s time to calculate for infinity. To start, accumulate all of your income sources and then you can make a decision of where to invest next.